- While the price of THORChain increased, the trading volume also increased significantly.

- The metrics showed that whales had a larger presence in the market.

THORChain [RUNE] has shown a commendable performance in the last 24 hours as its value has increased by double digits. While this was happening, the token also witnessed a sharp increase in its trading volume.

Let’s take a closer look at what enabled the token to have this bull market and whether this trend would continue.

THORChain starts a rally

CoinMarketCaps Data revealed that the price of RUNE increased by over 16% last week. Things got even better in the last 24 hours, with the token increasing in value by more than 13%.

AAt the time of writing, THORChain was $3.70 with a market cap of over $1.2 billion, making it the 55th largest cryptocurrency.

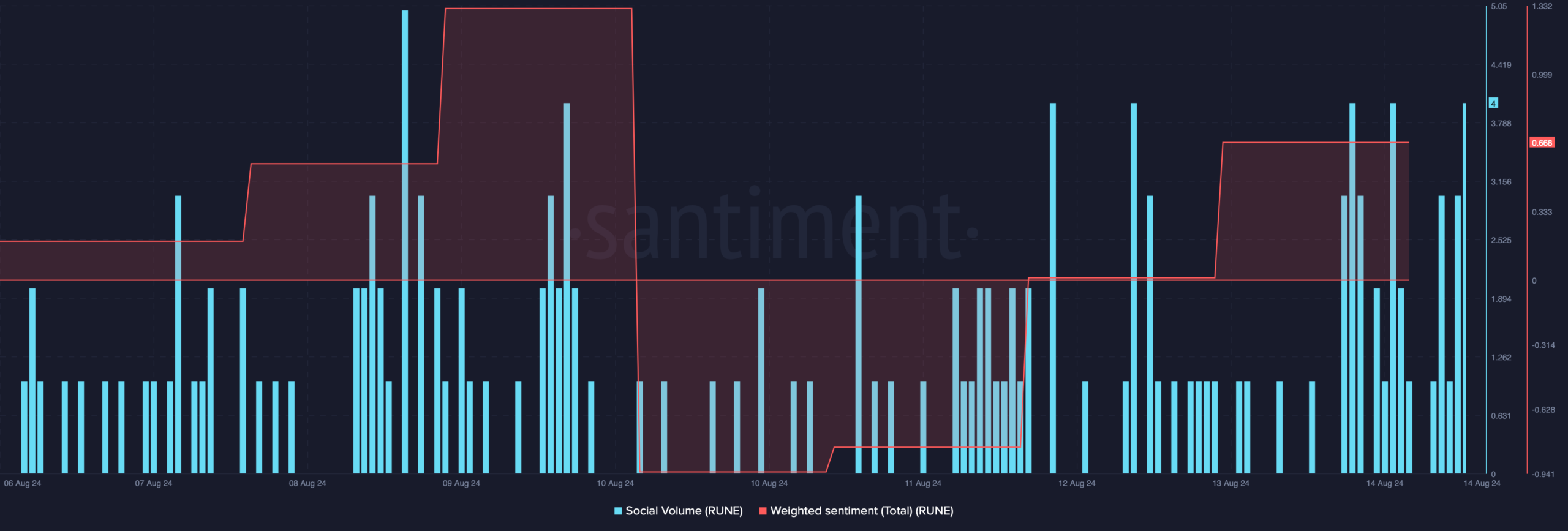

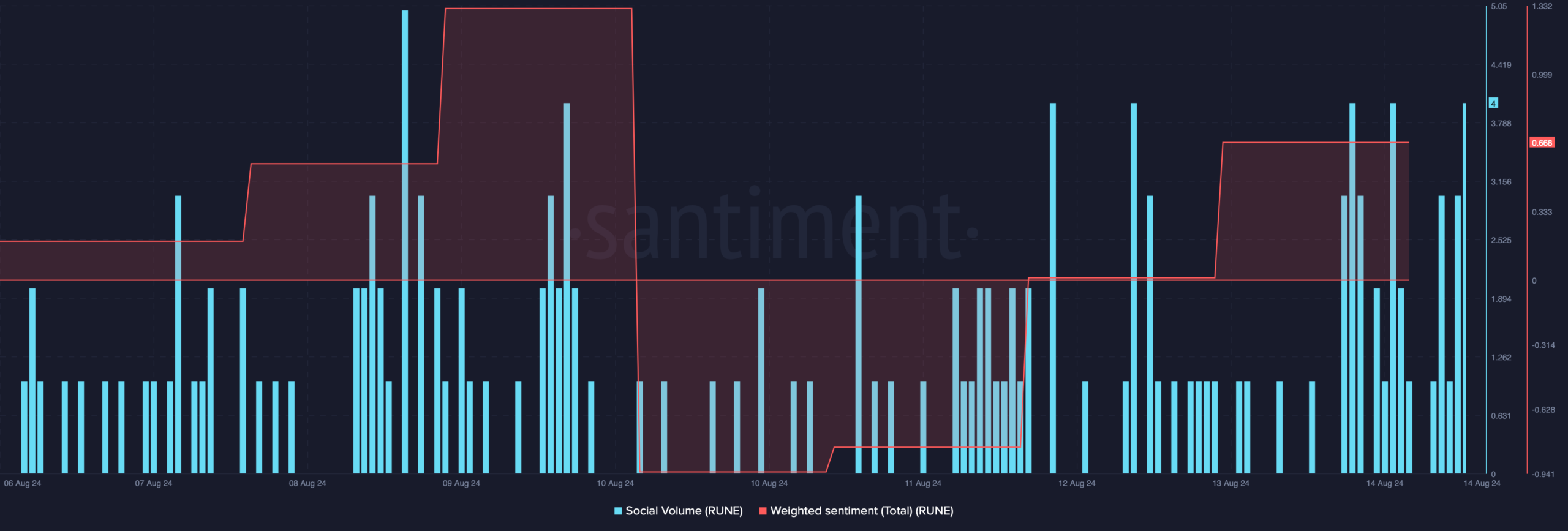

Thanks to the price increase, the token’s weighted sentiment moved into the positive zone, meaning that bullish sentiment around the token was prevalent in the market.

Its social volume also remained high, reflecting RUNE’s increasing popularity in the crypto space.

Source: Santiment

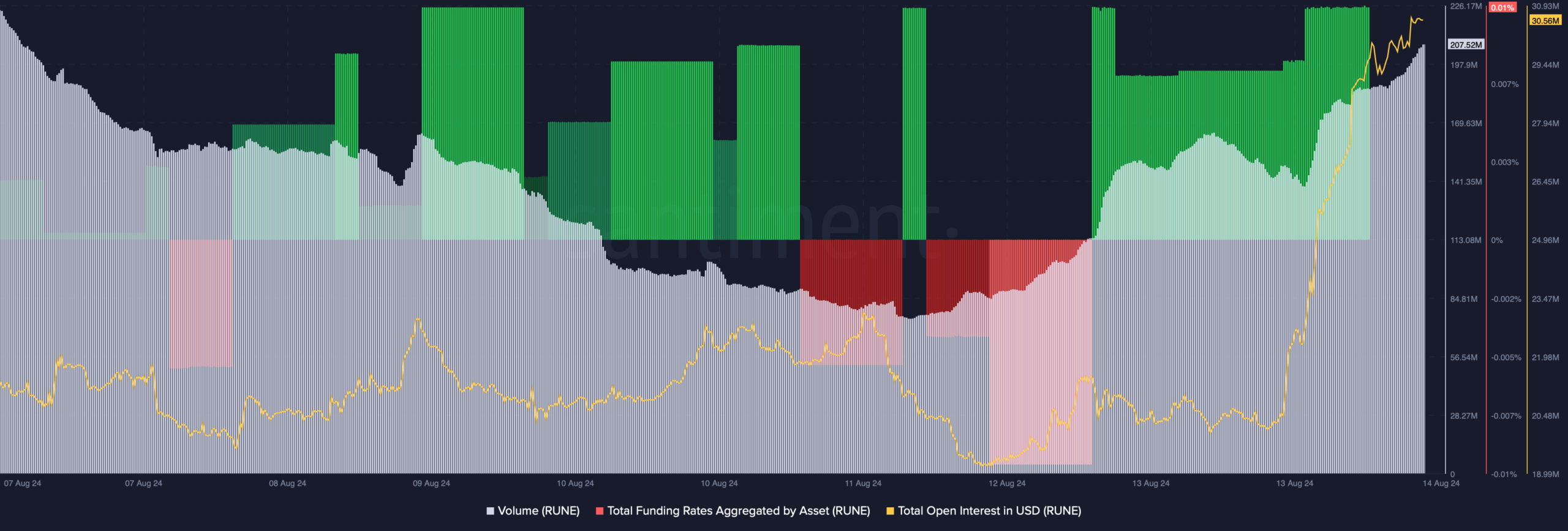

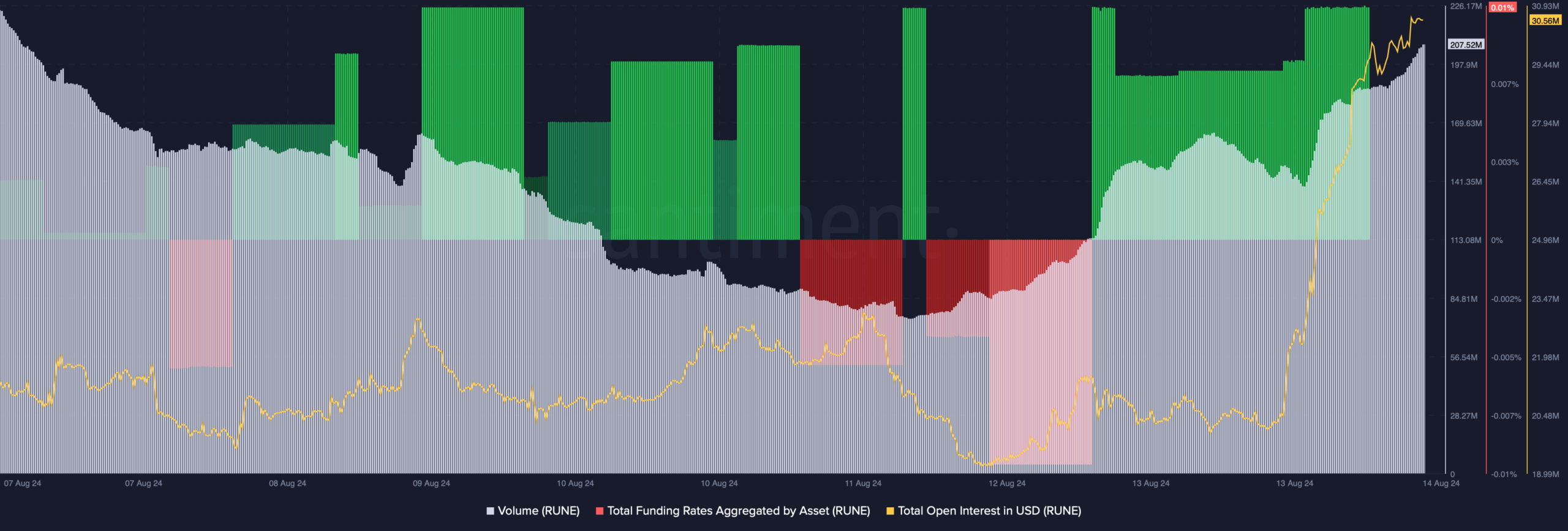

Upon closer inspection, AMBCrypto found that the token’s trading volume increased along with its price. Usually, an increase in volume when the price rises is a solid foundation for bullishness.

Open interest increased, indicating that there is a high probability that the bull rally will continue. However, RUNE’s funding rate also increased.

In general, prices tend to move in the opposite direction to financing rates, which is a pessimistic sign.

Source: Santiment

Will the bull rally continue?

AMBCrypto’s look at Hyblock Capital’s data revealed that the delta between THORChain whales and retail trade was at 96 at press time.

This indicator ranged from -100 to 100, with 0 representing exactly equal positioning of whales and retail.

Since the value was much closer to 100, this meant that whales had a higher long exposure than retail investors.

Source: Hyblock Capital

Apart from that, Coinglass data showed that RUNE’s long/short ratio saw a sharp increase.

This indicated that there were more long than short positions in the market, which in turn indicated that there was an optimistic sentiment in the market.

Source: Glassnode

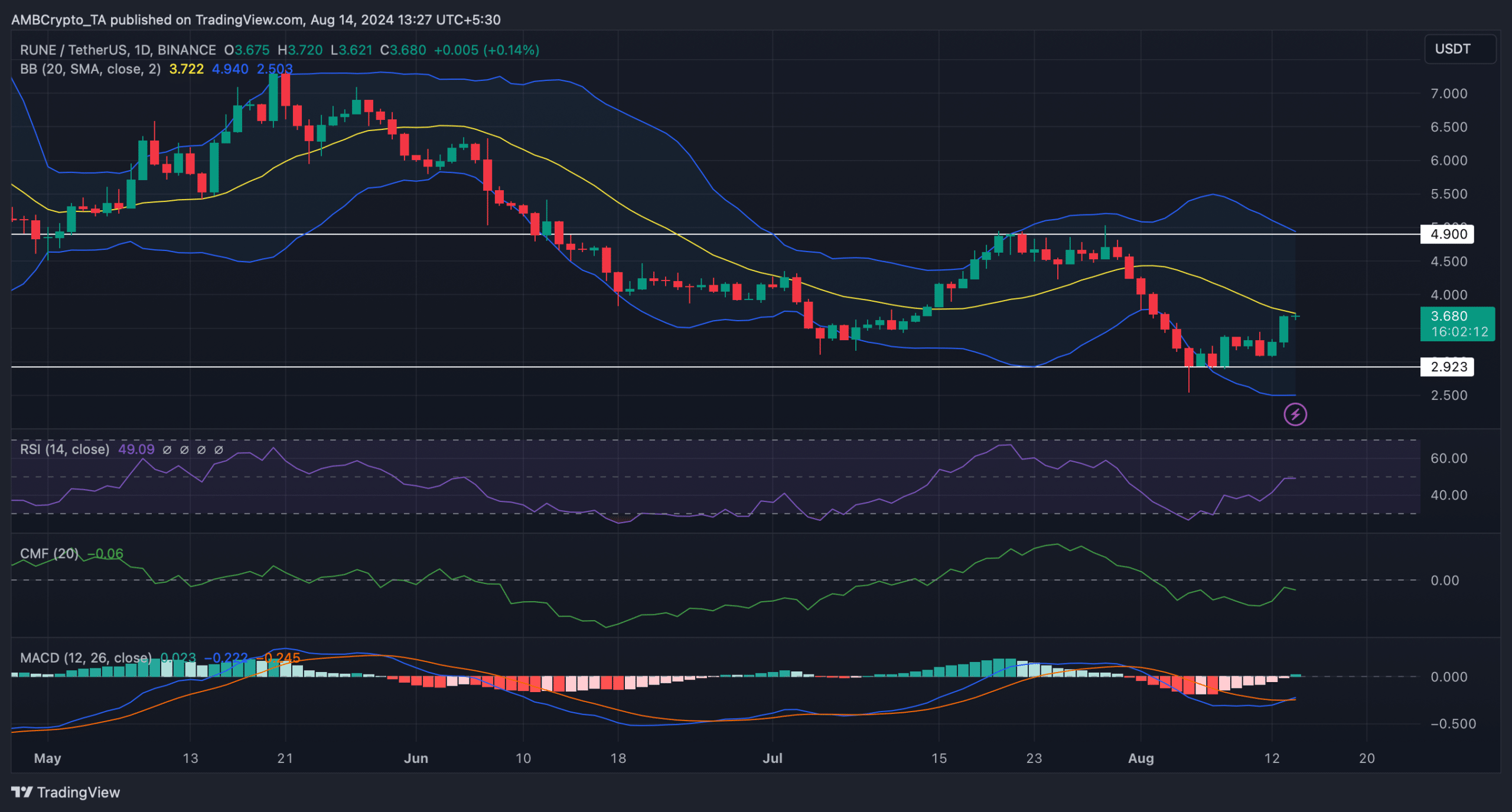

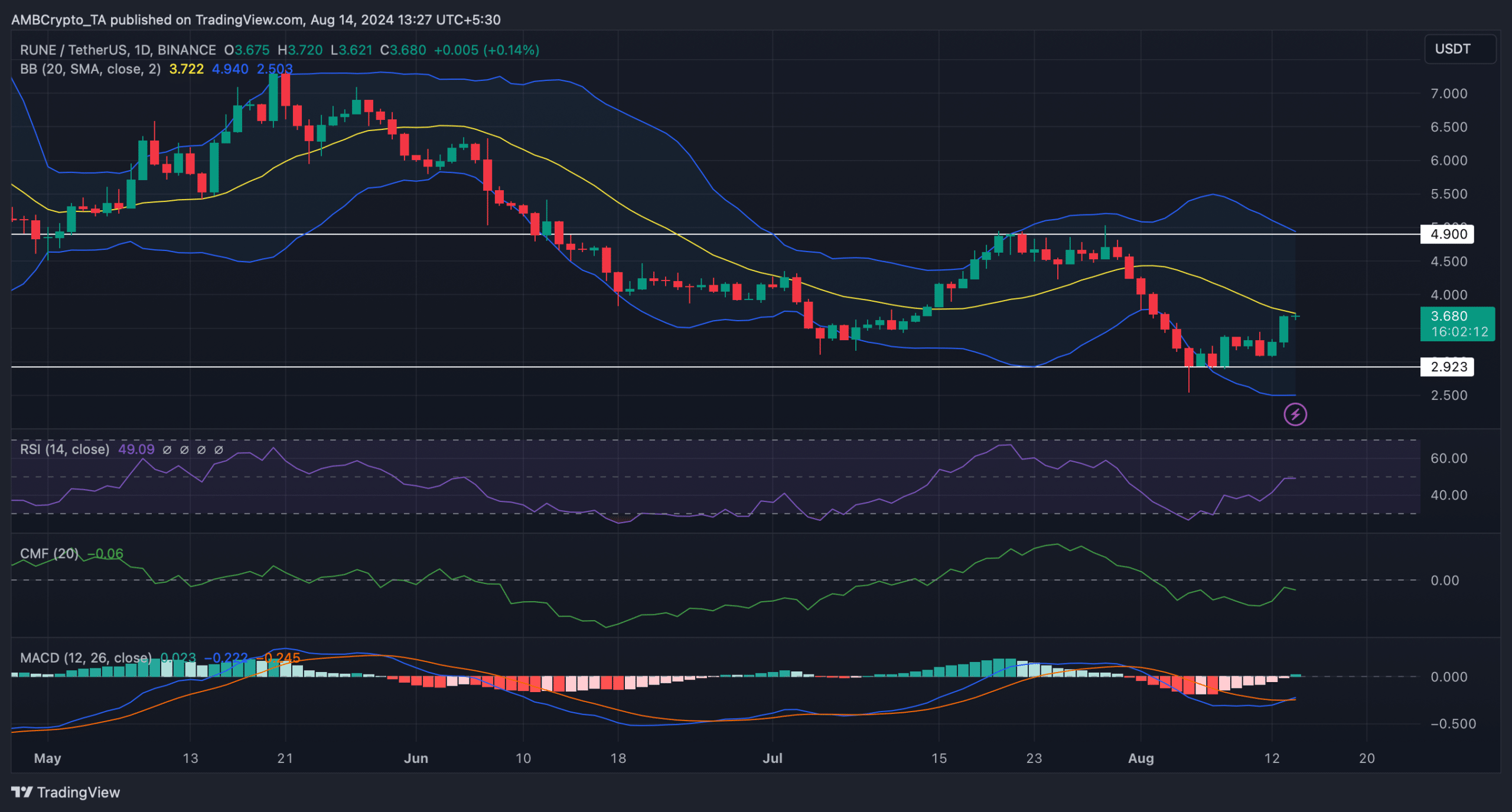

Next, we wanted to look at THORChain’s daily chart to better understand if this uptrend would continue. The MACD technical indicator showed a bullish crossover.

To read THORChain [RUNE] Price prediction 2024-25

RUNE’s Bollinger Bands showed that the token’s price was testing its resistance near the 20-day Simple Moving Average (SMA). A successful breakout above it would allow the token to reclaim $4.9-$5.

However, both the Relative Strength Index (RSI) and the Chaikin Money Flow (CMF) recorded slight declines, suggesting that the bull rally may soon come to an end.

Source: TradingView