- Marathon Digital announces an ambitious plan to promote Bitcoin investments.

- Bitcoin supply reserves of all exchanges reach the lowest level since 2018.

Marathon Digital, a leading Bitcoin [BTC] The mining company plans to raise $250 million to buy more bitcoins.

After making $100 million worth of purchases in July, Marathon now holds 20,000 BTC. Recent data shows that large investors, known as whales, have been steadily increasing their BTC holdings over the past few months, indicating strong market confidence.

This institutional commitment was evident in the steady rise in accumulation indicators, supported by various measures, including supply reserves.

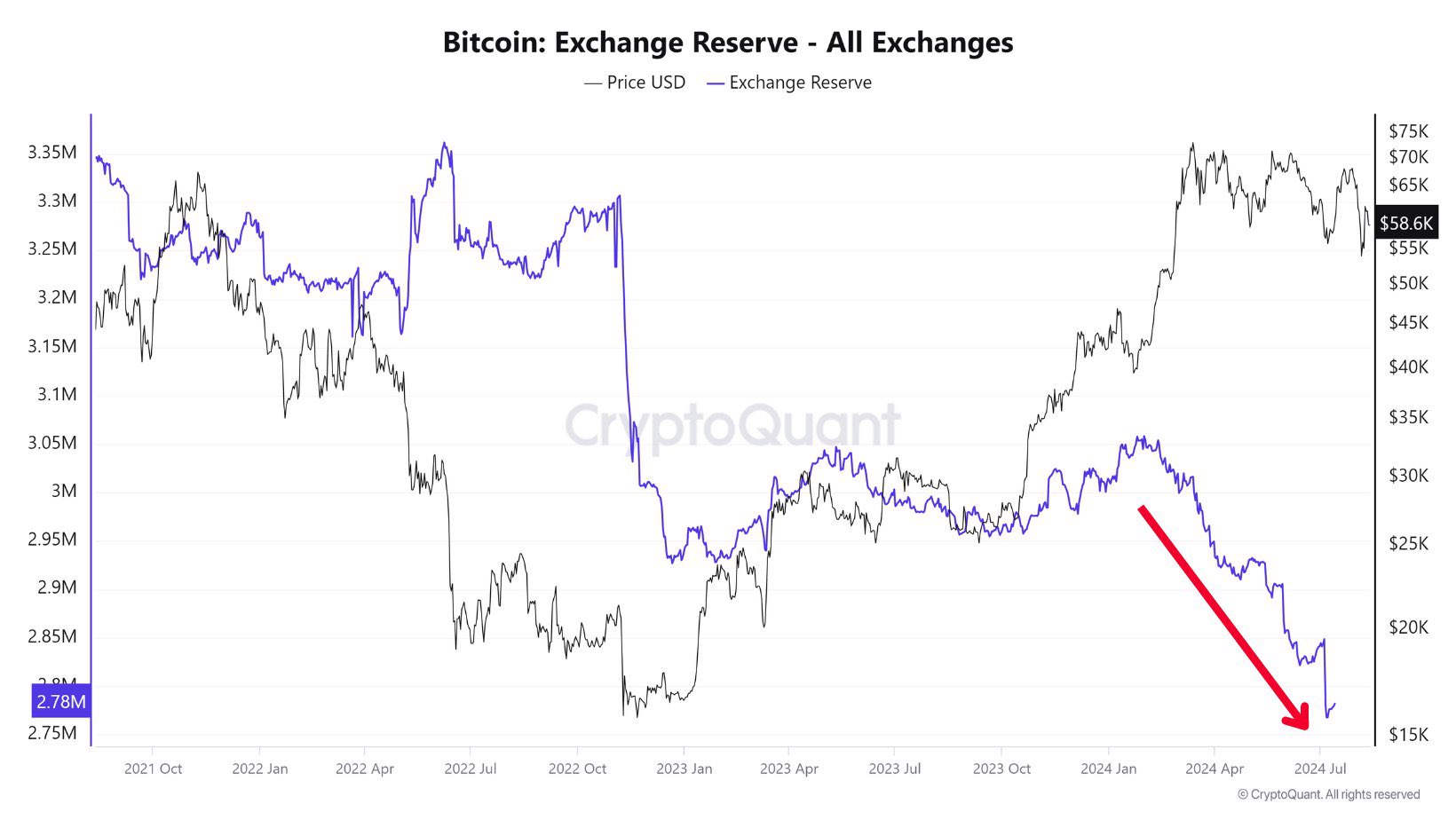

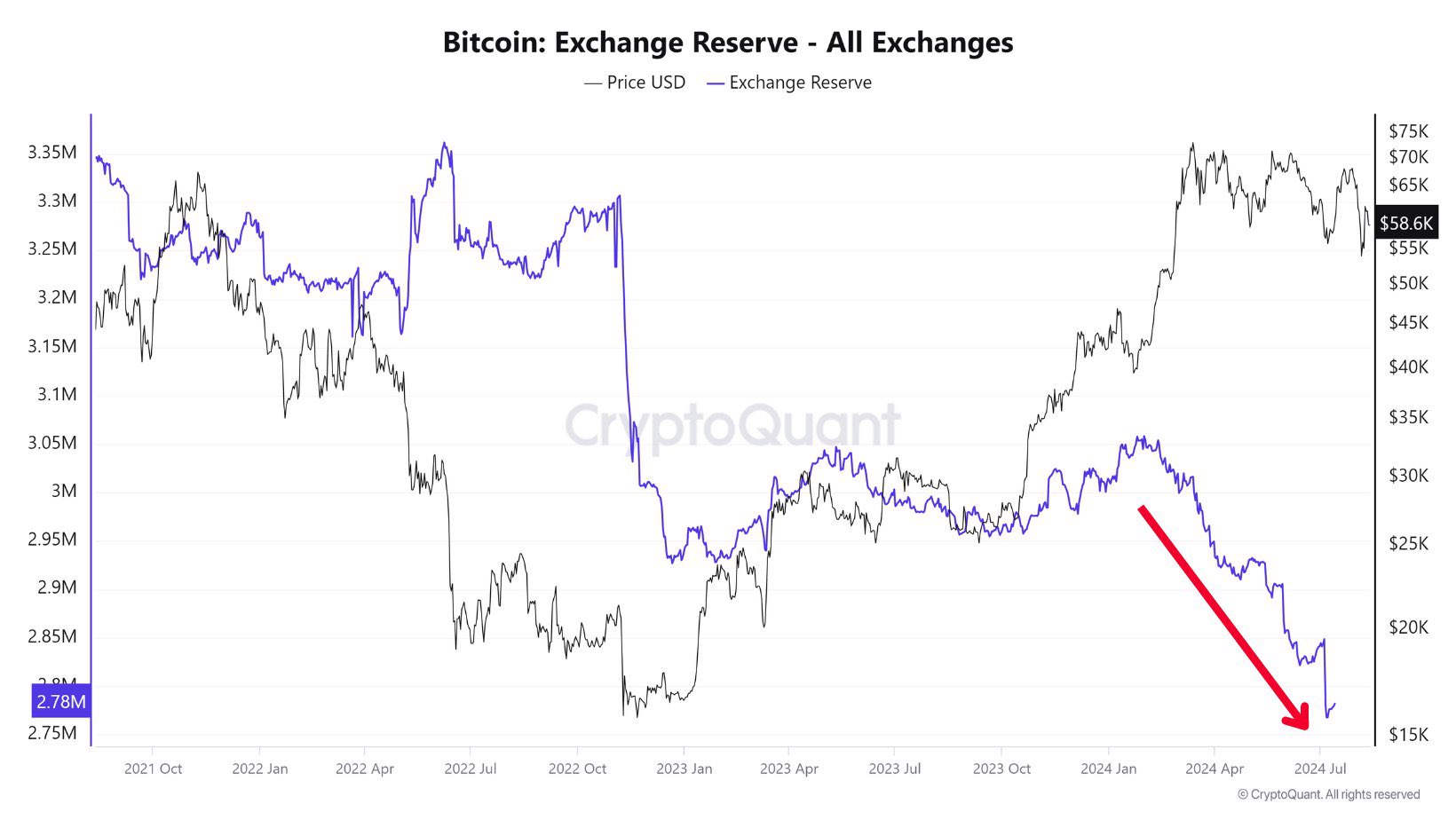

Source: CryptoQuant

BTC reserves on all exchanges have also fallen to their lowest levels since 2018, with a significant decline observed since the beginning of the year.

This suggests that institutions are continuously accumulating Bitcoin, probably because they expect a positive market trend.

Such a decline in available supply is a strong optimistic signal and indicates growing investor confidence in the future of Bitcoin.

For this reason, now is the time to consider being bullish on BTC given the market changes.

Liquidation levels

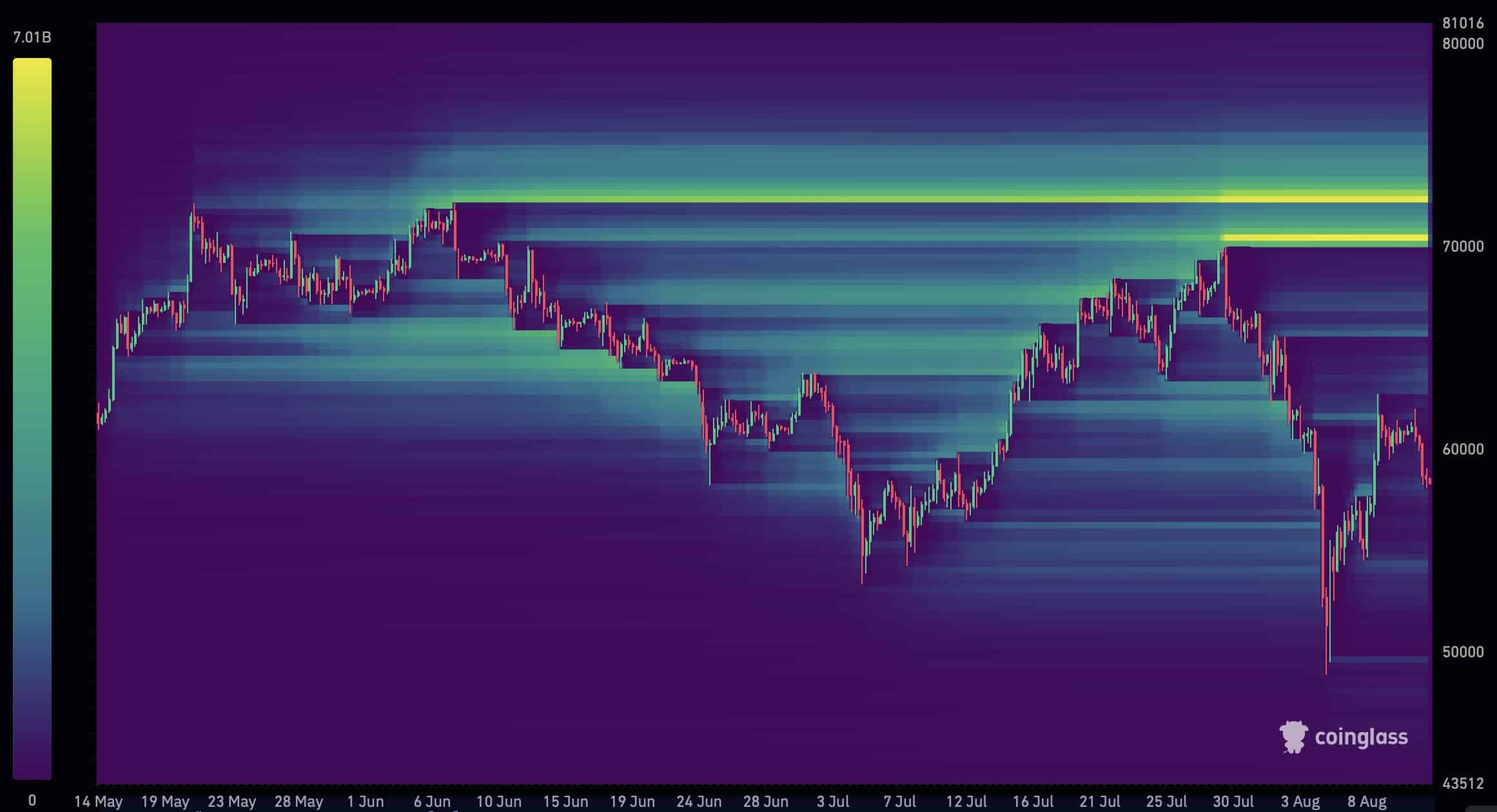

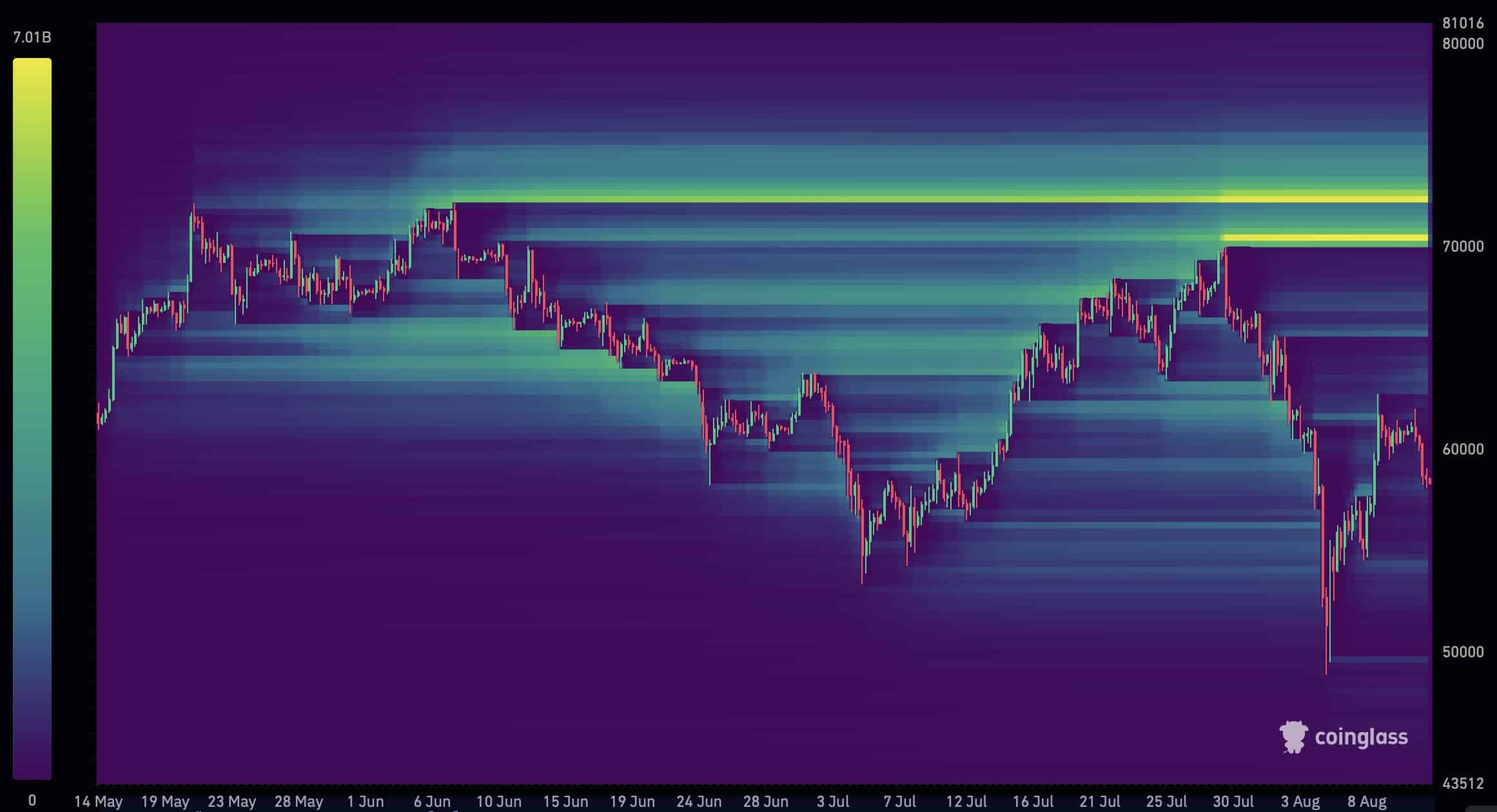

According to Coinglass, over $15 billion worth of BTC short positions will be liquidated if the price hits $72,000.

Significant liquidity is between $70,000 and $72,000, indicating a market shift as large institutions accumulate BTC for long-term gains.

Source: Coinglass

Bitcoin opens another CME gap

This week, Bitcoin created another CME gap, in addition to the two major gaps it recently closed, with the recent close marking a local top at $63,000.

A new gap is now above the $61,000 price mark. While gaps do not always close, they often do, indicating price increases towards the gap.

Source: TradingView

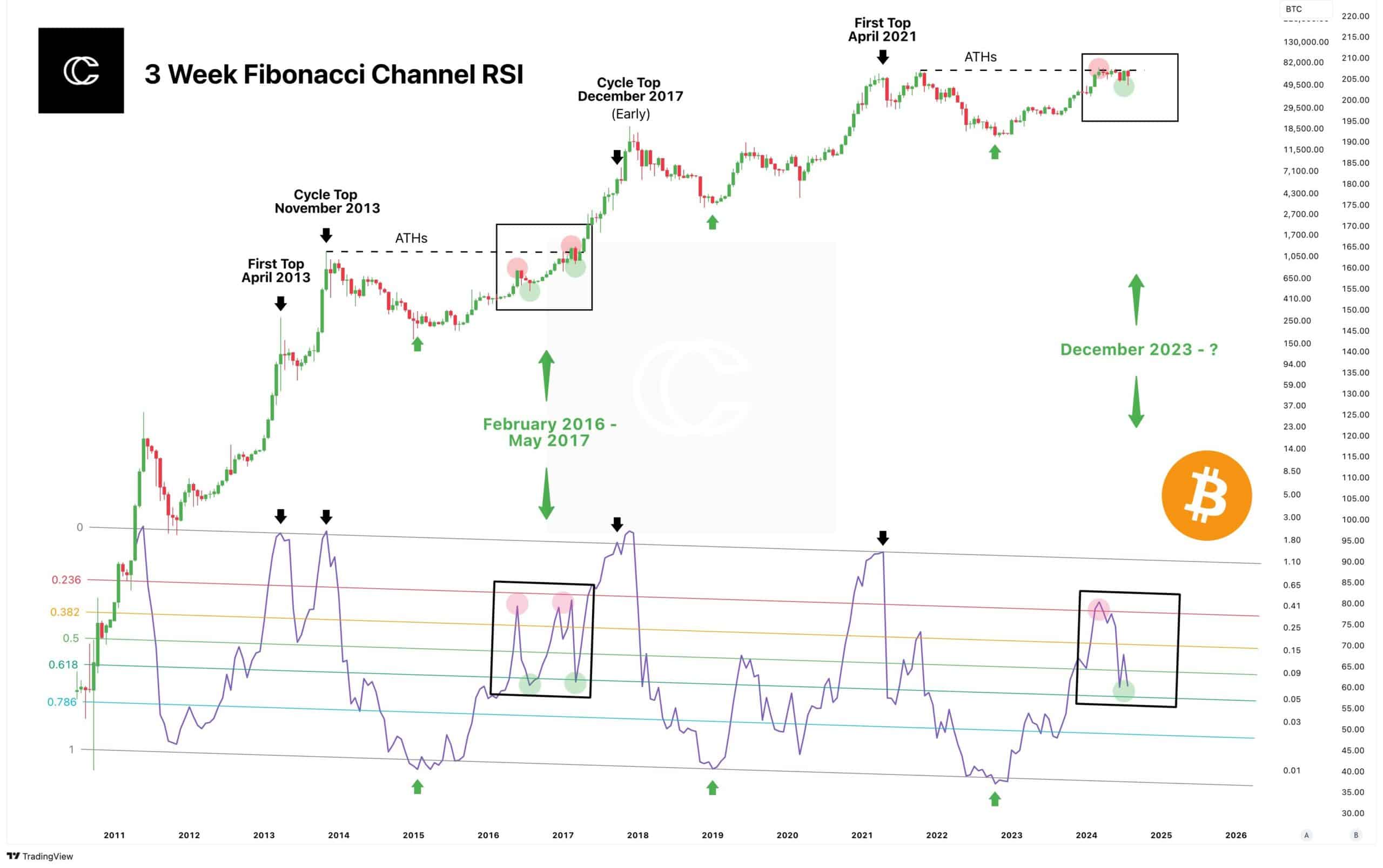

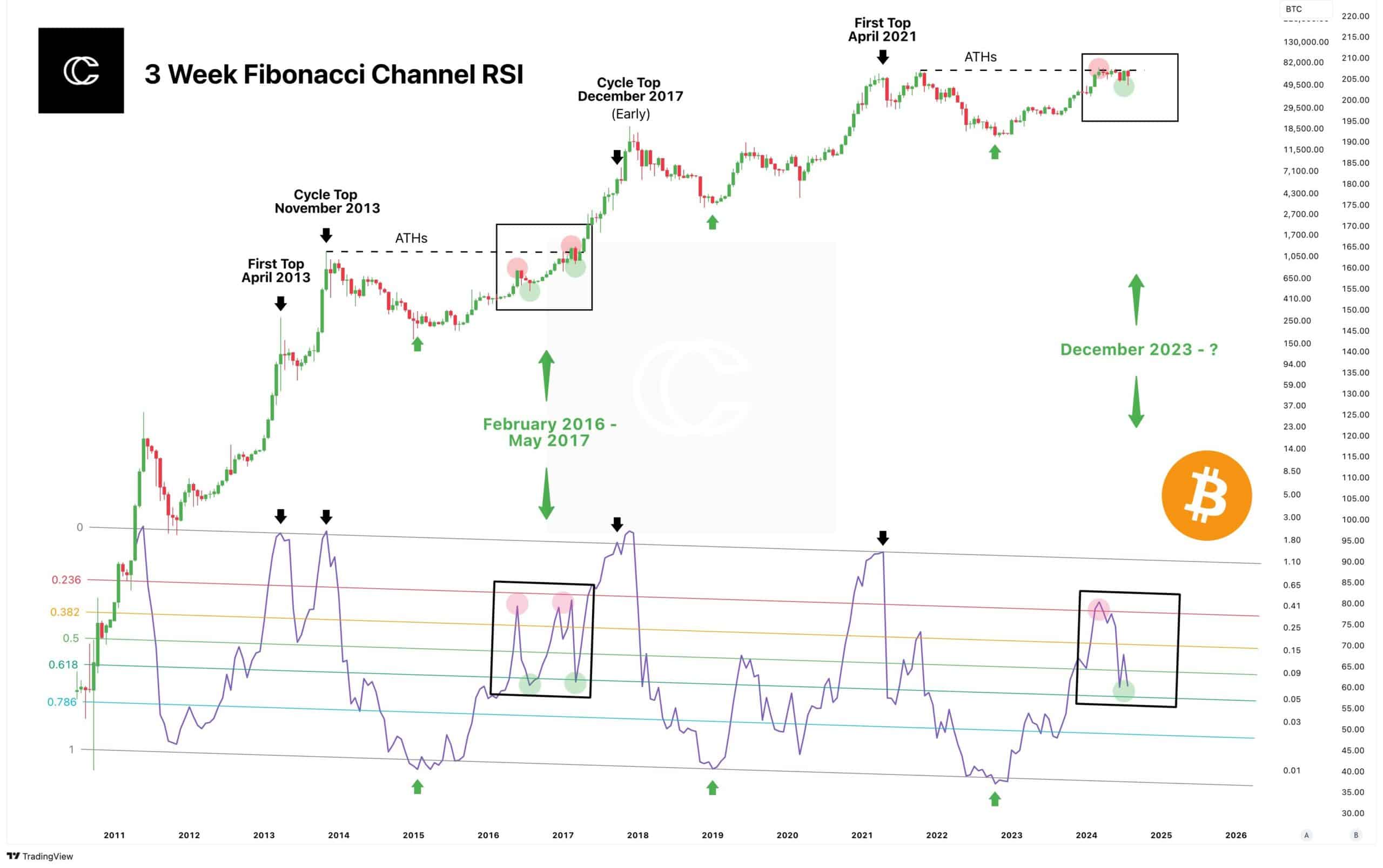

Bitcoin RSI using Fibonacci level analysis

The AMBCrypto analytics team noted that Bitcoin’s 2-week RSI hit cycle peaks, but the 3-week RSI provided a clearer overview of market sentiment.

Is your portfolio in the green? Check out the BTC profit calculator

BTC’s RSI pattern now reflects the 2016-2017 period when it was aiming for new highs.

Unlike previous cycle tops, this suggests that the March 2024 move was significant, but it is believed that the bull market could last for over a year once institutions have completed their accumulation.

Source: TradingView