- The failure of the middle support was a major blow to the bulls.

- A move towards the low of $122 is possible, but the $140 level could also deter sellers.

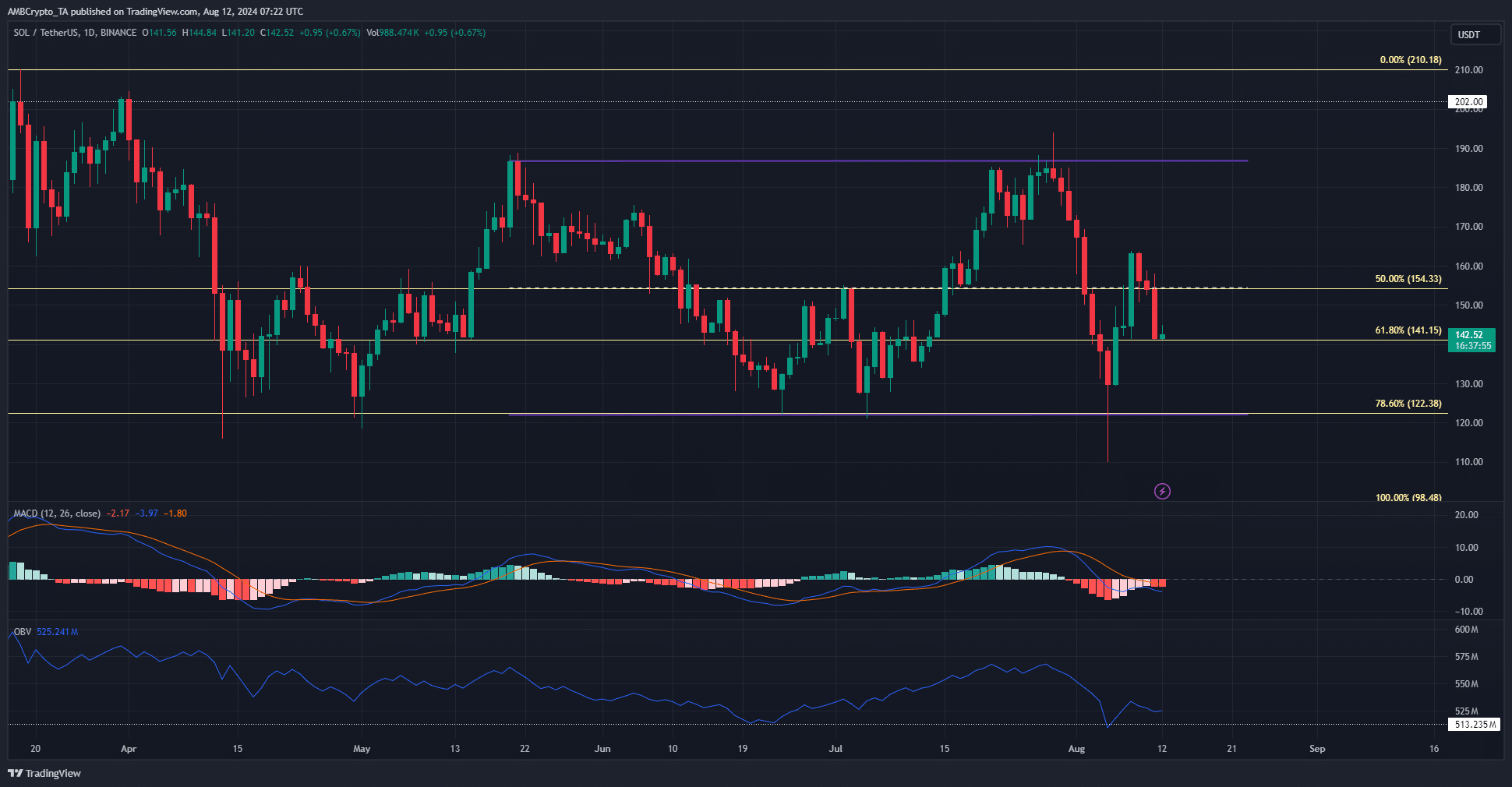

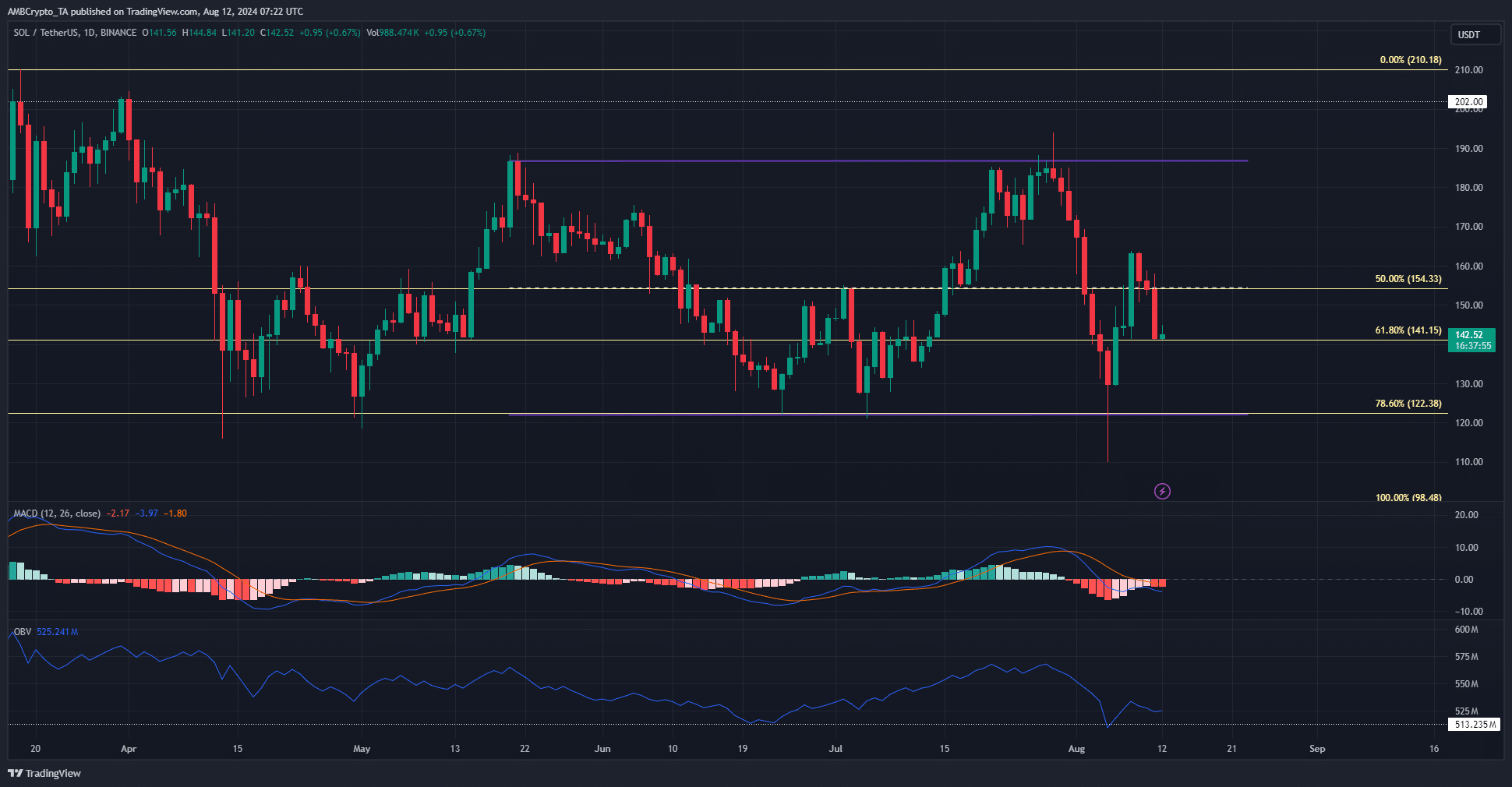

Solana [SOL] was back below the $150 mark and the bearish hurdles were getting larger. The breakout above $160 should trigger a move to the range highs at $190, with the sentiment also turning bullish last week.

However, this did not last.

Bitcoin [BTC] Bulls were rejected at the $62,500 resistance zone. Solana followed in the crypto king’s footsteps as he retreated, and this journey is likely to have one more leg south.

Solana’s middle support was decisively broken

Source: SOL/USDT on TradingView

Solana traded within a three-month-old range that ranged from $122 to $186. The middle range at $154 coincided with the 50% Fibonacci retracement level created based on the February and March rally.

These levels were still relevant, with the 78.6% level coinciding with the range’s lows. The failure of buyers to defend the middle support over the weekend meant that the short-term bias was once again bearish.

The OBV recovered from the June lows and showed some bullish strength. However, the MACD formed a bearish crossover and fell below the zero line. The momentum was clearly bearish and demand was not high enough to fend it off.

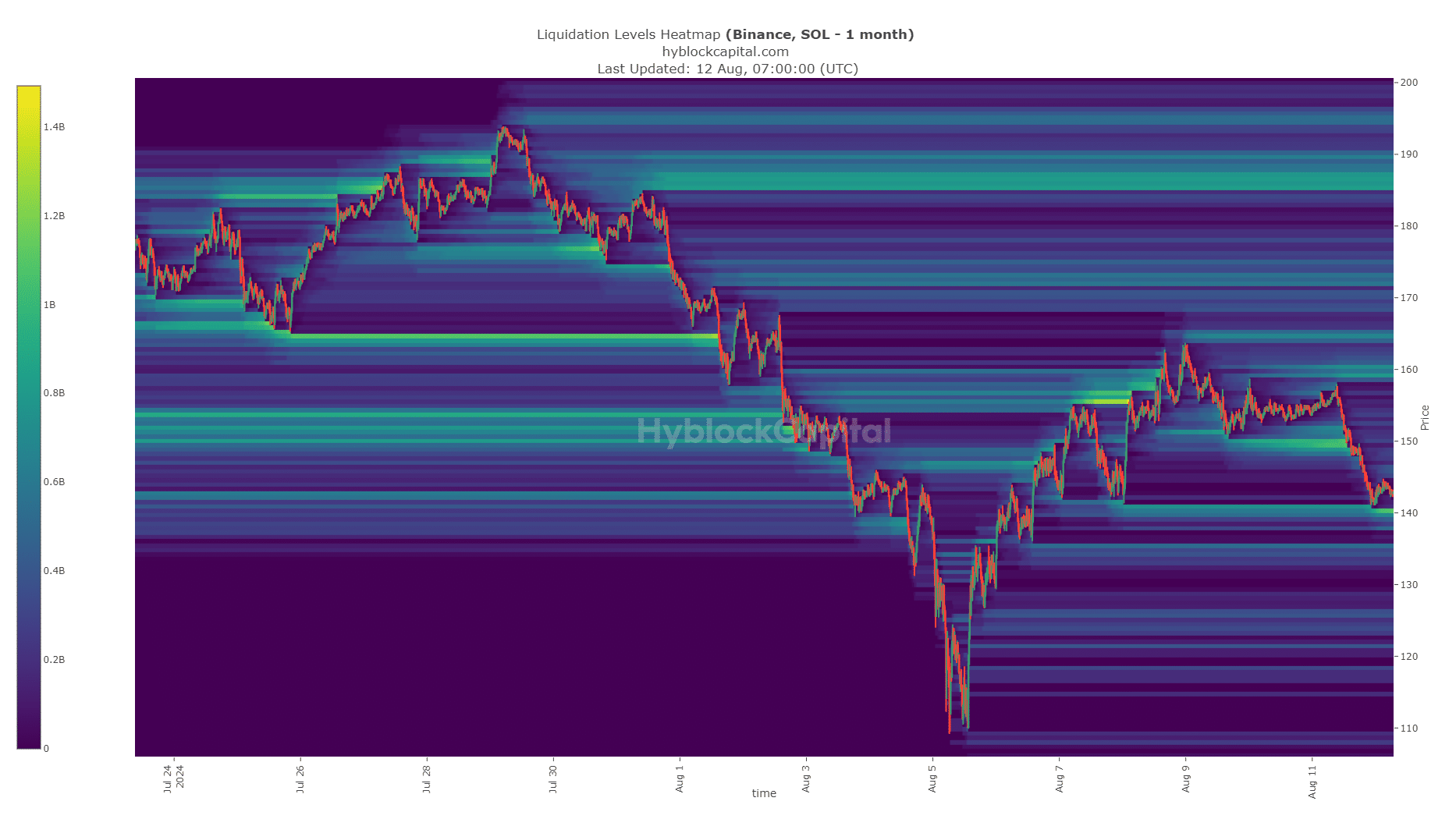

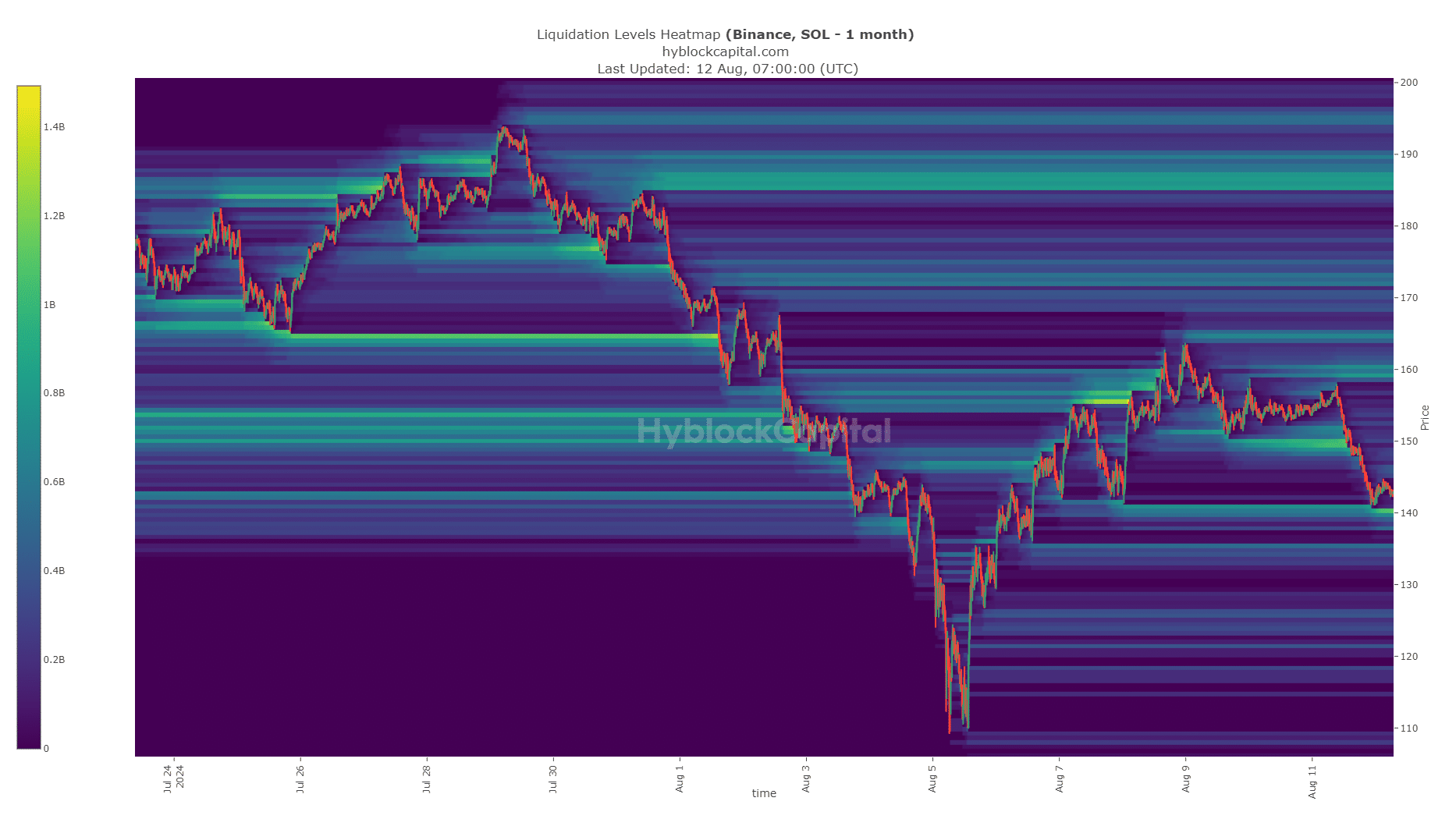

Could the $140 liquidity gap reverse the bearish trends?

Source: Hyblock

AMBCrypto found that there was a significant liquidity reserve at $140, which is likely to pull prices lower. However, there was also a short-term bullish trend reversal here on August 7.

Is your portfolio green? Check the Solana Profit Calculator

Traders need to be wary of a similar scenario. Overall, the lack of demand and bearish momentum could push Solana below $140 towards $130 or even lower to the lows.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and reflects solely the opinion of the author.