- Due to a hidden bullish divergence, Fantom could potentially see a 234% price increase.

- Javon Marks believes that the price of FTM could reach a high of $3, triggering a significant price rally.

Phantom [FTM] has seen more modest gains compared to other major altcoins this year. While altcoins like Solana and Toncoin have risen by over 100%, FTM is only up 40% year-to-date.

FTM has been facing downward pressure recently, falling 5.7% over the past day to a current price of $0.3393. Despite this short-term setback, the asset showed strong performance last week, rising over 15% and briefly reaching above $0.36 on Sunday, August 11.

234% rally in sight

Javon Marks, a crypto community analyst, has highlighted a promising scenario for FTM.

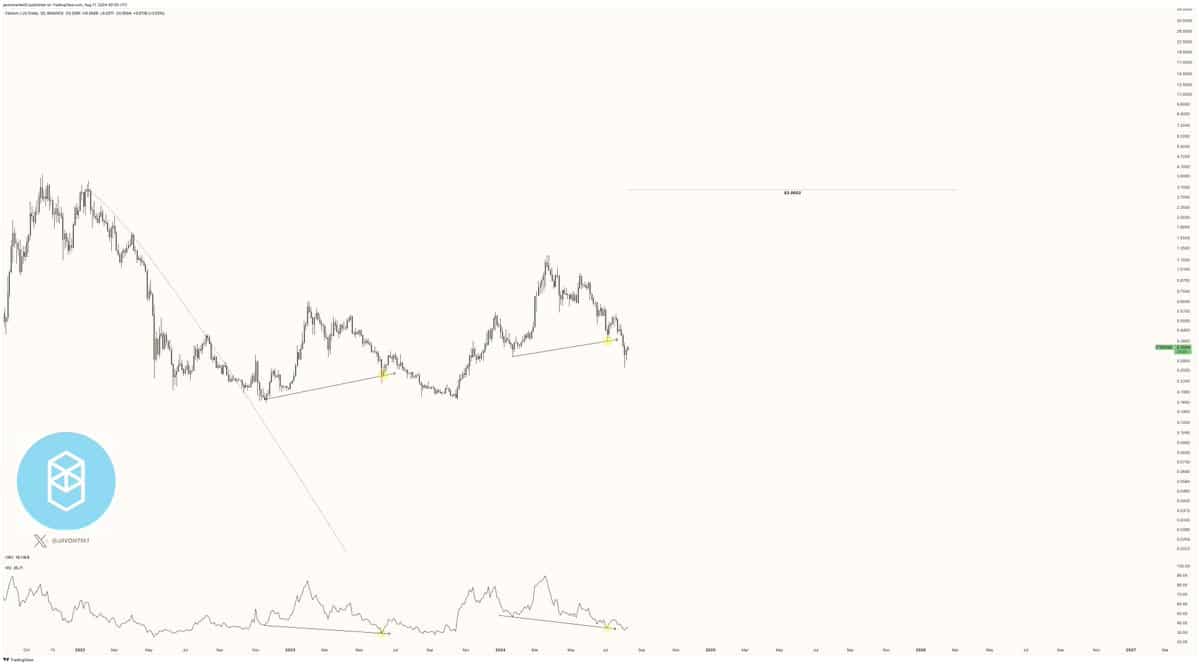

According to Marks, Fantom is showing signs of a hidden bullish divergence on its charts, a technical signal often associated with potential upside price moves.

This pattern suggests that the underlying momentum could be preparing for a significant uptrend despite recent price declines.

A hidden bullish divergence occurs when price makes a higher low while the oscillator makes a lower low. This discrepancy between price action and momentum often indicates a sustained bullish sentiment that could lead to significant price increases.

Marks speculates that this setup could help FTM rise as much as 234%. Such a rally would not only reverse recent losses but could also propel the cryptocurrency to new heights, potentially reaching the $3 mark.

This bullish outlook is further reinforced by Fantom’s recent price activity, which has shown volatility with recovery potential. Marks pointed out that similar declines have initiated significant price increases in the past.

Source: Javon Marks on X

Marks explained in a post:

“Fantom’s recent confirmation of a hidden bullish divergence, although followed by a correction, is consistent with previous patterns that preceded major price rallies.”

This pattern suggests a possible rise towards a long-term target of $3.0053, a crucial breakout level for FTM.

Fundamental outlook for Fantom (FTM)

While technical analysis predicts an optimistic future, it is important to consider FTM’s underlying fundamentals.

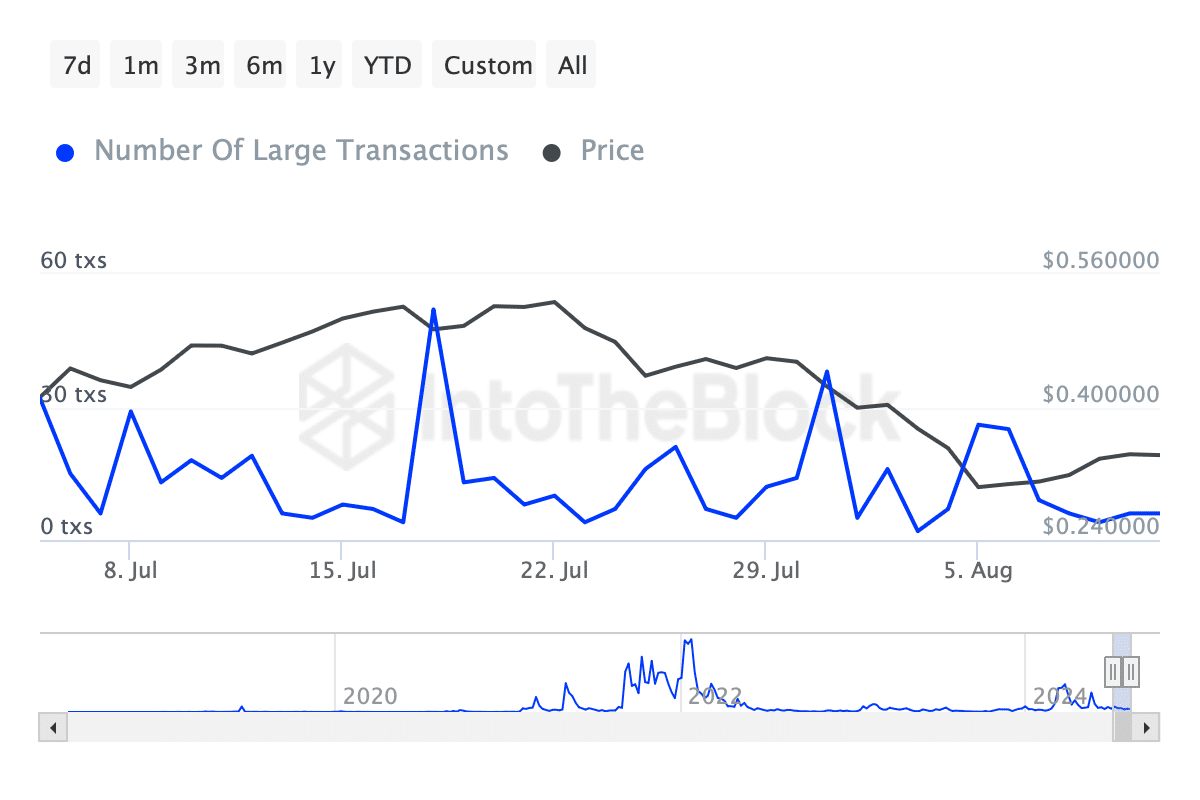

The number of large transactions (Whale transactions), which can serve as an indicator of smart money movements, has seen a significant decline from over 20 significant transactions last week to just 6 this week.

Source: IntoTheBlock

This decline in whale activity could indicate a temporary decline in investor confidence or a consolidation phase before a potential rally.

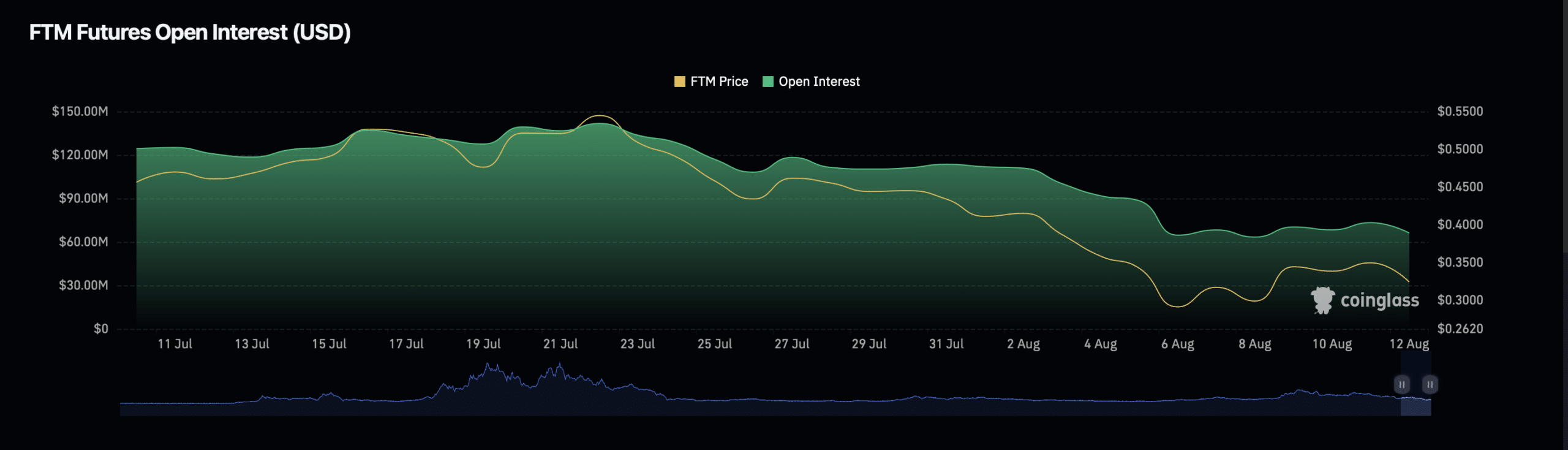

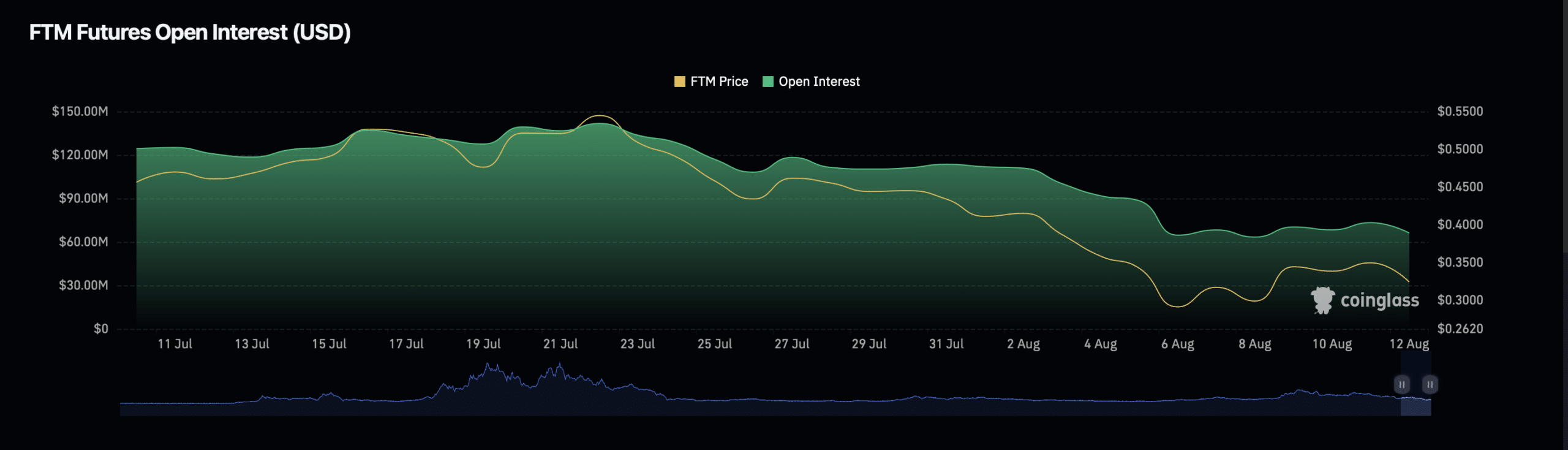

In addition, there were also mixed trends in FTM open interest, which reflects the total number of outstanding derivatives contracts (e.g., unsettled futures).

Source: Coinglass

Realistic or not, here is FTM’s market cap in SOL terms

While there was a decline of 9.2% in Open interestindicating a cooling of leverage positions, the open interest volume increased by 47.59%.

This increase could indicate that new money is entering the market, possibly in anticipation of future price increases.